Why Custom Research Outperforms AI-Driven Deal Sourcing Platforms

- Yash Duseja

- Oct 17, 2025

- 2 min read

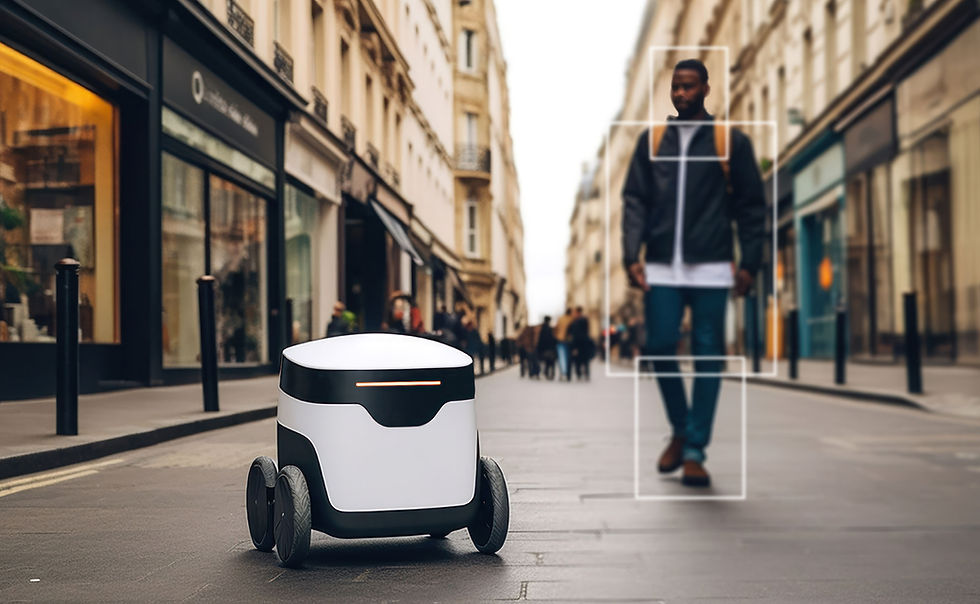

AI has become part of the toolkit for many deal sourcing platforms. These platforms promise efficiency with algorithmic matching, predictive models, and automated data processing. They pull in massive amounts of data from public filings, news, financials, social media, and even alternative signals to surface acquisition targets, quickly and at scale.

But despite the wow factor, there’s a gap between what AI platforms promise and what private equity professionals ultimately need.

Here is why custom research often beats AI when it comes to generating truly actionable target lists.

AI Uses Purchased Data and Public Sources

AI deal sourcing platforms are built on a mix of purchased data sets, open data, and, scraped content. They often rely on structured databases from third party providers, and may even ingest public data like filings or news feeds. But if a company is absent from those sources or not labeled clearly, it never appears in the output.

By comparison, my research process taps into the full breadth of publicly available information on the web and applies a methodology built over years of M&A work. The result is a structured, actionable target list that surfaces opportunities traditional platforms often miss.

Automation Scales but Doesn't Go Deep

AI is excellent for speed and scale. It can screen markets using complex rules, evaluate thousands of targets fast, and maintain updated lists of potential deals.

But humans, for all their limitations, still bring judgment. Automation can align targets with high-level criteria like sector or size. What it cannot do is understand nuance in ownership structure, business model subtleties, or whether a company is truly in play or even accessible.

A curated, manual process gives you depth. It ensures each target is verified and presented with structure that’s ready to support outreach or strategic analysis.

Freshness and Accuracy Matter

Platforms often pull from static datasets or lagging public records. By the time someone appears in the system, they may already be working with another buyer.

Custom research is built to order. It connects real time data with human validation so the results you receive are fresh and reliable the moment they reach you.

Lower Middle-Market Funds Feel the Difference

For funds in the lower mid-market, sourcing budgets are tight. Subscriptions and platform costs can take a big part of your budget, and if the output is generic or stale, that’s a real drain.

Custom research delivers a sharper, more complete view of the market. It often highlights owner led companies that don’t appear in platform searches, giving smaller funds a real edge without overspending.

The Bottom Line

AI powered sourcing platforms bring speed and breadth. They help scan information fast and generate models of opportunity across large datasets.

But when the goal is an exclusive, precise, and truly proprietary target list, the investment in depth and curation pays off. In highly competitive markets, seeing what others miss isn’t a luxury. It’s a necessity.

If your firm values seeing opportunities that sourcing platforms often miss, I’d be happy to discuss further. yash@agathonrp.com